Self Employed Business Deductions 2024 – The good news for self-employed taxpayers is that medical expenses may be tax deductible, but it’s important to understand the rules that apply. For the tax years 2023 and 2024, the IRS has updated . This rate serves as the basis for calculating deductible mileage expenses incurred while conducting business activities. 2024 Mileage Rate: Looking ahead to 2024, the standard mileage rate for .

Self Employed Business Deductions 2024

Source : www.amazon.com

Top Tax Write offs for the Self Employed TurboTax Tax Tips & Videos

Source : turbotax.intuit.com

Amazon.com: Tax Year Diary 2023 2024: Tax Year Diary for Self

Source : www.amazon.com

IRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.com

Amazon.com: Mileage Log book 2024: For Self Employed, Journal

Source : www.amazon.com

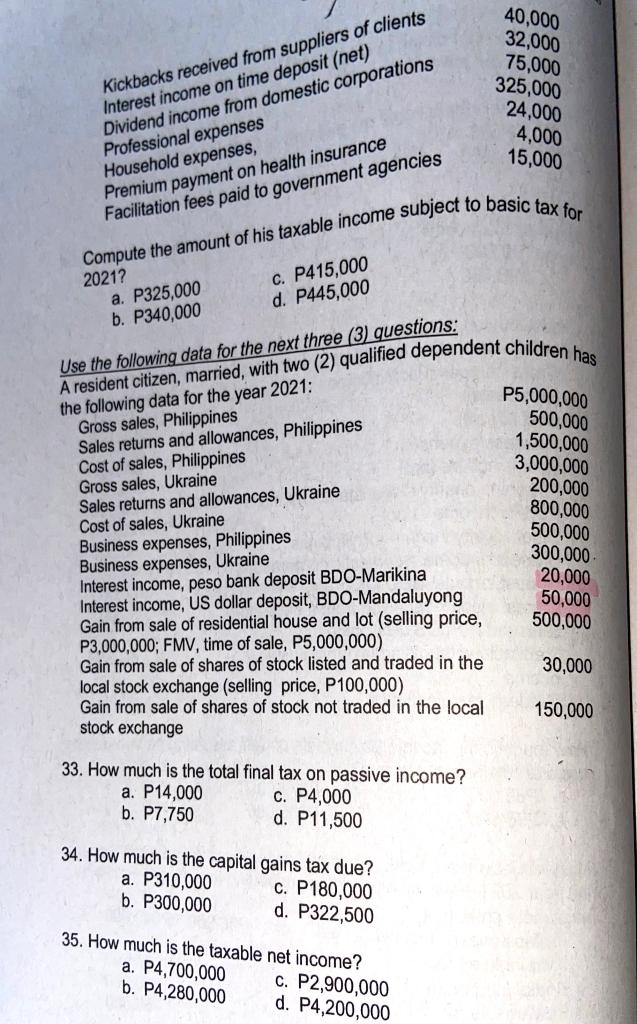

Solved Use the following data for the next two (2) questions

Source : www.chegg.com

Amazon.com: Tax Year Diary April 2023 April 2024: Tax Year Diary

Source : www.amazon.com

Tax Firm Empire

Source : www.facebook.com

Amazon.com: tax year diary 2024 2025: A5 Financial year diary week

Source : www.amazon.com

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

Self Employed Business Deductions 2024 Amazon.com: mileage log book for taxes for self employed 2024 : Investing in a solo 401(k) is a common retirement savings plan for self-employed individuals or small business owners. Let’s break down how it works, gets taxed and what potential deductions you can . “The updated mileage rates for self-employed individuals in 2023 and 2024 are designed to provide clarity and fairness in the realm of deductible business expenses. We recognize the importance of .